What’s Driving the Economic Recovery?

Now past the halfway point of 2021, we’d like to review what drove performance in the first two quarters – and what areas struggled to keep up – as well as highlight our market outlook for the second half of the year.

The drivers and the laggards

As global economies continued their post-pandemic recovery, equites and commodities achieved double-digit returns. Canadian equities delivered the strongest results amongst developed markets thanks to the energy and financials sectors. The Canadian dollar also did well against all major currencies due to improving demand for commodities and a rosier economic outlook.

Emerging markets trailed developed markets as slower vaccine administration and the spread of new strains of COVID-19 tempered returns. Globally, cyclical sectors with more leverage to the economic cycle delivered the strongest performance, while more defensive sectors lagged. Also, the value factor was the best performing factor for the first time since 2016.

Within fixed income, returns were mixed. Interest-rate sensitive areas like government bonds experienced negative returns as yields increased in response to expectations for a strong economic recovery and rising inflation. However, high-yield corporate bonds were positive for the year, buoyed by tightening credit spreads and risk-on sentiment.

Our outlook for 2021

In our 2021 market outlook, we shared our view that this year would be very different from the last. 2020 returns were driven by “stay-at-home” areas of the market – technology, large-cap companies and the U.S. equity market. We also predicted the winners in 2021 would be “reopening” areas of the market. So far, our expectations have been correct, and we believe the second half of the year will bring more of the same.

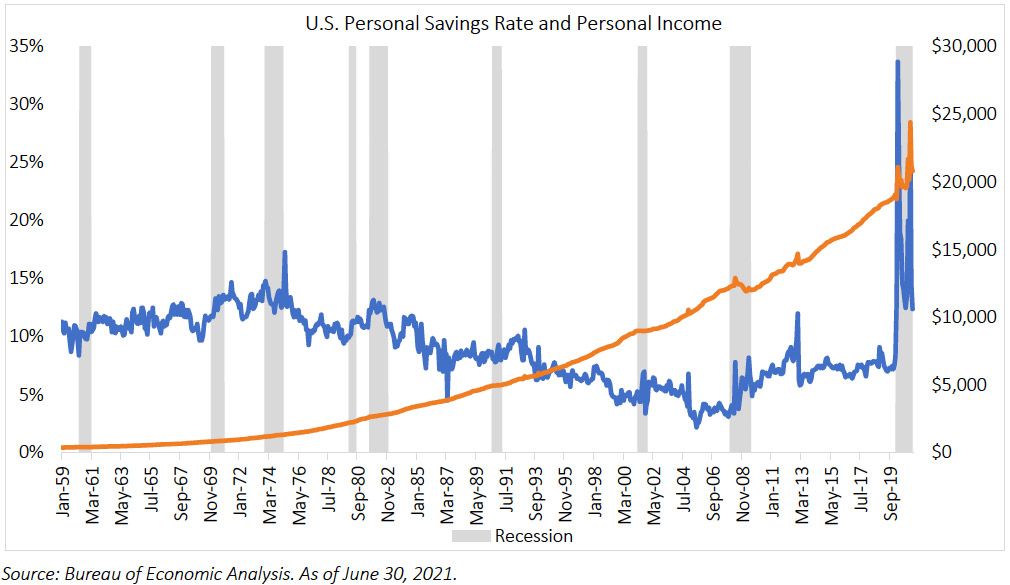

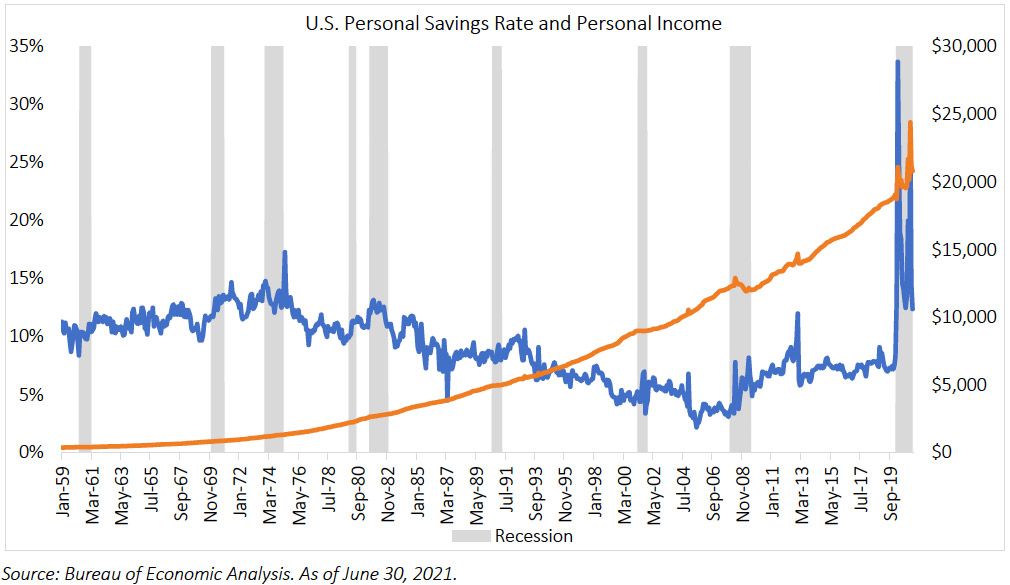

Our macroeconomic outlook for the rest of 2021 is bullish. With vaccine deployments, accommodative monetary and fiscal policy, and elevated savings rates, both lending and consumption should increase as economies reopen, with a high probability for exceptional economic growth.

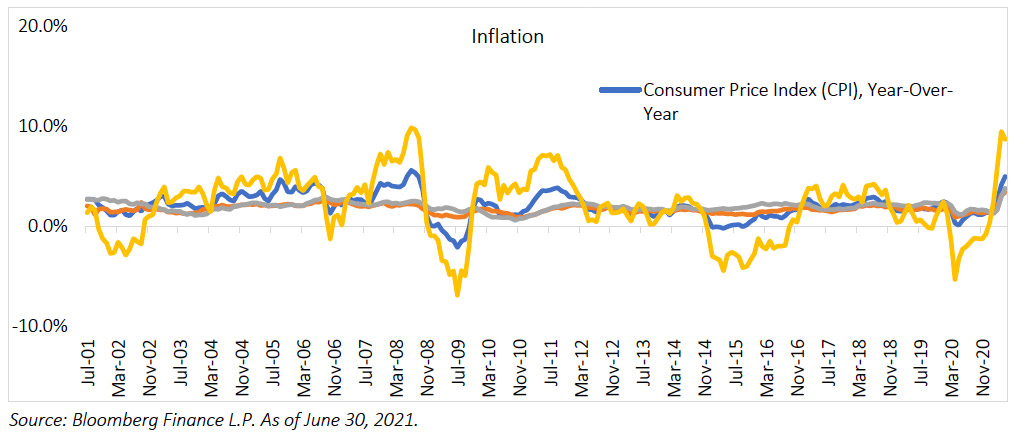

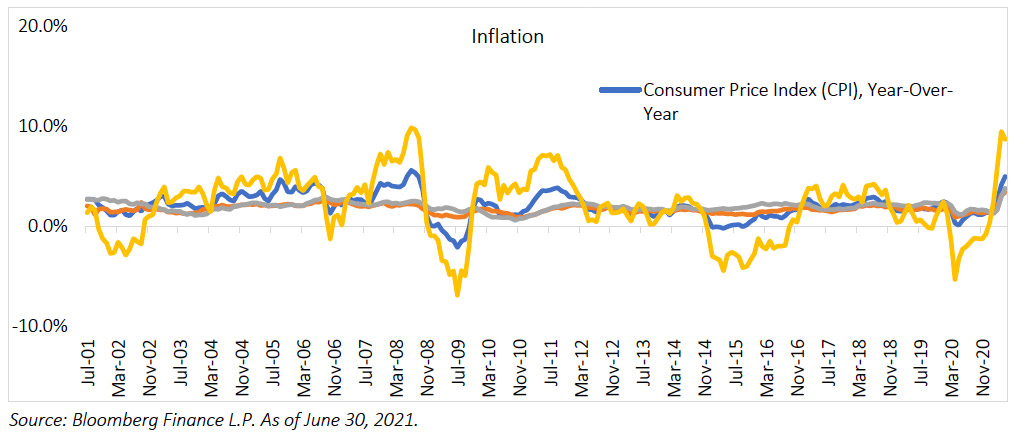

We continue to favour equity over fixed income. Inflation will likely fall from its current peak but stay elevated, and we remain focused on protecting our investors’ purchasing power. In equity markets, a strong economy should continue to support corporate earnings growth and drive markets higher. We still prefer cyclical sectors and factors that are levered to economic growth. We also expect long-term interest rates will trend higher over the rest of the year.

Looking at fixed income, we maintain a shorter duration and prefer corporate bonds. While some commodity prices are cooling, the strong performance from oil should continue in the coming months. We expect the Organization of Petroleum Exporting Countries’ (OPEC) supply discipline and recovering demand to counter concerns about COVID-19 cases around the world.

Delivering returns through tactical asset allocation

In summary, we are very pleased with the strong absolute and relative returns we’ve been able to deliver for our investors. As the post-pandemic recovery plays out around the world, we will continue to use our portfolios’ flexible mandates to tactically allocate assets to take advantage of the opportunities and manage any risks as they arise.

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

Marchello Holditch, CFA, CAIA, Vice-President and Portfolio Manager, CI GAM | Multi-Asset Management

This document is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. This report may contain forward-looking statements about one or more funds, future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. CI Assante Wealth Management and its dealer subsidiaries, Assante Capital Management Ltd. and Assante Financial Management Ltd. (collectively “Assante”) are affiliates of CI GAM | Multi-Asset Management, which is a division of CI Global Asset Management. Evolution Private Managed Accounts are managed by CI Global Asset Management under the United Financial brand and are available exclusively through your Assante advisor. Neither CI Global Asset Management nor its affiliates or their respective officers, directors, employees or advisors are responsible in any way for damages or losses of any kind whatsoever in respect of the use of this report. Commissions, trailing commissions, management fees and expenses may all be associated with investments in mutual funds and the use of the Asset Management Service. Any performance data shown assumes reinvestment of all distributions or dividends and does not take into account sales, redemption or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the fund prospectus and consult your advisor before investing. CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. CI Global Asset Management is a registered business name of CI Investments Inc. This report may not be reproduced, in whole or in part, in any manner whatsoever, without prior written permission of CI Assante Wealth Management. Copyright © 2021 CI Assante Wealth Management. All rights reserved.

Now past the halfway point of 2021, we’d like to review what drove performance in the first two quarters – and what areas struggled to keep up – as well as highlight our market outlook for the second half of the year.

The drivers and the laggards

As global economies continued their post-pandemic recovery, equites and commodities achieved double-digit returns. Canadian equities delivered the strongest results amongst developed markets thanks to the energy and financials sectors. The Canadian dollar also did well against all major currencies due to improving demand for commodities and a rosier economic outlook.

Emerging markets trailed developed markets as slower vaccine administration and the spread of new strains of COVID-19 tempered returns. Globally, cyclical sectors with more leverage to the economic cycle delivered the strongest performance, while more defensive sectors lagged. Also, the value factor was the best performing factor for the first time since 2016.

Within fixed income, returns were mixed. Interest-rate sensitive areas like government bonds experienced negative returns as yields increased in response to expectations for a strong economic recovery and rising inflation. However, high-yield corporate bonds were positive for the year, buoyed by tightening credit spreads and risk-on sentiment.

Our outlook for 2021

In our 2021 market outlook, we shared our view that this year would be very different from the last. 2020 returns were driven by “stay-at-home” areas of the market – technology, large-cap companies and the U.S. equity market. We also predicted the winners in 2021 would be “reopening” areas of the market. So far, our expectations have been correct, and we believe the second half of the year will bring more of the same.

Our macroeconomic outlook for the rest of 2021 is bullish. With vaccine deployments, accommodative monetary and fiscal policy, and elevated savings rates, both lending and consumption should increase as economies reopen, with a high probability for exceptional economic growth.

We continue to favour equity over fixed income. Inflation will likely fall from its current peak but stay elevated, and we remain focused on protecting our investors’ purchasing power. In equity markets, a strong economy should continue to support corporate earnings growth and drive markets higher. We still prefer cyclical sectors and factors that are levered to economic growth. We also expect long-term interest rates will trend higher over the rest of the year.

Looking at fixed income, we maintain a shorter duration and prefer corporate bonds. While some commodity prices are cooling, the strong performance from oil should continue in the coming months. We expect the Organization of Petroleum Exporting Countries’ (OPEC) supply discipline and recovering demand to counter concerns about COVID-19 cases around the world.

Delivering returns through tactical asset allocation

In summary, we are very pleased with the strong absolute and relative returns we’ve been able to deliver for our investors. As the post-pandemic recovery plays out around the world, we will continue to use our portfolios’ flexible mandates to tactically allocate assets to take advantage of the opportunities and manage any risks as they arise.

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

Marchello Holditch, CFA, CAIA, Vice-President and Portfolio Manager, CI GAM | Multi-Asset Management

This document is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. This report may contain forward-looking statements about one or more funds, future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. CI Assante Wealth Management and its dealer subsidiaries, Assante Capital Management Ltd. and Assante Financial Management Ltd. (collectively “Assante”) are affiliates of CI GAM | Multi-Asset Management, which is a division of CI Global Asset Management. Evolution Private Managed Accounts are managed by CI Global Asset Management under the United Financial brand and are available exclusively through your Assante advisor. Neither CI Global Asset Management nor its affiliates or their respective officers, directors, employees or advisors are responsible in any way for damages or losses of any kind whatsoever in respect of the use of this report. Commissions, trailing commissions, management fees and expenses may all be associated with investments in mutual funds and the use of the Asset Management Service. Any performance data shown assumes reinvestment of all distributions or dividends and does not take into account sales, redemption or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the fund prospectus and consult your advisor before investing. CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. CI Global Asset Management is a registered business name of CI Investments Inc. This report may not be reproduced, in whole or in part, in any manner whatsoever, without prior written permission of CI Assante Wealth Management. Copyright © 2021 CI Assante Wealth Management. All rights reserved.