Update on the Russia/Ukraine Situation

The news of Russia invading Ukraine created rattles in capital markets this morning. However, it was a known concern so a fair bit of the downside had already been reflected in asset prices before this morning.

Update on our views and positioning

Going into today, we were holding a larger amount of USD, Yen, and government bonds. We expect them to perform well throughout this volatility.

The markets are always evolving. During times of volatility, we constantly review of our holdings. In fact, the first thing our team did this morning is to go through the holdings to ensure:

- What we own make sense for our investors’ investment time horizon. (While a portfolio of cash and foreign currencies make the most sense on days like today, its important to look through short term volatility)

- The thesis is still valid.

Generally, we believe:

- Given Russia is an exporter of commodities, any disruptions and sanctions will we lead to higher commodity prices for longer. This also means higher inflation globally.

- Depending on the details and size of the sanction package, there could be economic implications to Europe as there is more interconnection between Russia and Europe. This also means the European Central Bank (ECB) may take a more dovish stance on rates.

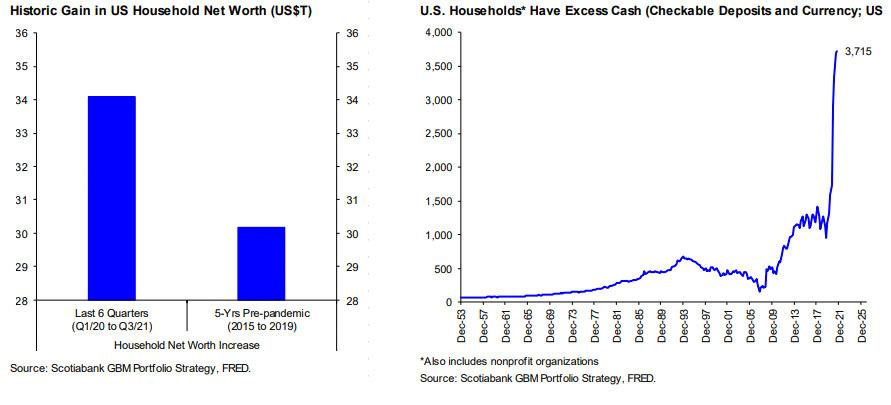

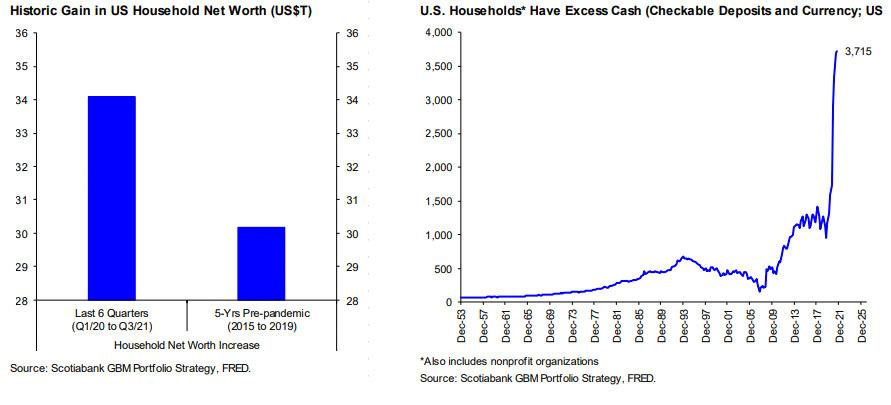

- Global stocks, as measured by the MSCI World Index, have sold off 10% prior to the invasion and should find bottoms in the near term. Fundamentals remain solid with strong job markets, growing wages, and growing demand. US households are in solid position to spend and invest. Net worth has risen $34 trillion since the pandemic, and they are holding $3.7 trillion cash. As we write, S&P 500 is down less than 2%, which to us signals a calm reaction.

Source: Scotiabank GBM portfolio Strategy, FRED

- The Fed and the Bank of Canada will go ahead with hiking rates in March as inflation pressure is increasing, not decreasing driven by commodities. We believe, it is unlikely to tip both economies into recession.

- Sovereign bond yields will trade higher, and this is a window to trim/sell.

- The negative real yield dynamics on bonds has not changed. It might have gotten worse. Investors are looking for growth to preserve purchasing power.

As a result:

- We have a positive view on energy companies.

- We are confident in the long-term earnings prospect of companies we own.

- We are less bullish on Europe and will likely trim our exposure.

- We see a potential revaluation of Yen vs other currencies, especially the EURO as the Bank of Japan is not the only central bank not hiking

By Alfred Lam, CFA, MBA, Senior Vice-President and Chief Investment Officer, CI GAM | Multi-Asset Management

By Alfred Lam, CFA, MBA, Senior Vice-President and Chief Investment Officer, CI GAM | Multi-Asset Management

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management Inc. has taken reasonable steps to ensure their accuracy. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Global Asset Management and the portfolio manager believe to be reasonable assumptions, neither CI Global Asset Management nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

CI Global Asset Management is a registered business name of CI Investments Inc.

© CI Investments Inc. 2022. All rights reserved.

The news of Russia invading Ukraine created rattles in capital markets this morning. However, it was a known concern so a fair bit of the downside had already been reflected in asset prices before this morning.

Update on our views and positioning

Going into today, we were holding a larger amount of USD, Yen, and government bonds. We expect them to perform well throughout this volatility.

The markets are always evolving. During times of volatility, we constantly review of our holdings. In fact, the first thing our team did this morning is to go through the holdings to ensure:

- What we own make sense for our investors’ investment time horizon. (While a portfolio of cash and foreign currencies make the most sense on days like today, its important to look through short term volatility)

- The thesis is still valid.

Generally, we believe:

- Given Russia is an exporter of commodities, any disruptions and sanctions will we lead to higher commodity prices for longer. This also means higher inflation globally.

- Depending on the details and size of the sanction package, there could be economic implications to Europe as there is more interconnection between Russia and Europe. This also means the European Central Bank (ECB) may take a more dovish stance on rates.

- Global stocks, as measured by the MSCI World Index, have sold off 10% prior to the invasion and should find bottoms in the near term. Fundamentals remain solid with strong job markets, growing wages, and growing demand. US households are in solid position to spend and invest. Net worth has risen $34 trillion since the pandemic, and they are holding $3.7 trillion cash. As we write, S&P 500 is down less than 2%, which to us signals a calm reaction.

Source: Scotiabank GBM portfolio Strategy, FRED - The Fed and the Bank of Canada will go ahead with hiking rates in March as inflation pressure is increasing, not decreasing driven by commodities. We believe, it is unlikely to tip both economies into recession.

- Sovereign bond yields will trade higher, and this is a window to trim/sell.

- The negative real yield dynamics on bonds has not changed. It might have gotten worse. Investors are looking for growth to preserve purchasing power.

As a result:

- We have a positive view on energy companies.

- We are confident in the long-term earnings prospect of companies we own.

- We are less bullish on Europe and will likely trim our exposure.

- We see a potential revaluation of Yen vs other currencies, especially the EURO as the Bank of Japan is not the only central bank not hiking

By Alfred Lam, CFA, MBA, Senior Vice-President and Chief Investment Officer, CI GAM | Multi-Asset Management

By Alfred Lam, CFA, MBA, Senior Vice-President and Chief Investment Officer, CI GAM | Multi-Asset Management

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

This document is provided as a general source of information and should not be considered personal, legal, accounting, tax or investment advice, or construed as an endorsement or recommendation of any entity or security discussed. Every effort has been made to ensure that the material contained in this document is accurate at the time of publication. Market conditions may change which may impact the information contained in this document. All charts and illustrations in this document are for illustrative purposes only. They are not intended to predict or project investment results. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. Investors should consult their professional advisors prior to implementing any changes to their investment strategies. Certain statements contained in this communication are based in whole or in part on information provided by third parties and CI Global Asset Management Inc. has taken reasonable steps to ensure their accuracy. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained herein are based upon what CI Global Asset Management and the portfolio manager believe to be reasonable assumptions, neither CI Global Asset Management nor the portfolio manager can assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.

CI Global Asset Management is a registered business name of CI Investments Inc.

© CI Investments Inc. 2022. All rights reserved.