Forecasts and Outlooks: The Folly of Predicting the Future

It’s that time of year again – investment management companies are releasing their forecasts and outlooks for the second half of the year. And while these predictions can be intriguing, it’s important to remember that they are often unreliable.

Recent studies have shown that most market forecasts are incorrect. In fact, a study by CXO Advisory Group found that the average stock market forecast accuracy was just 47%. This means that if you flipped a coin, you would have a better chance of being right.

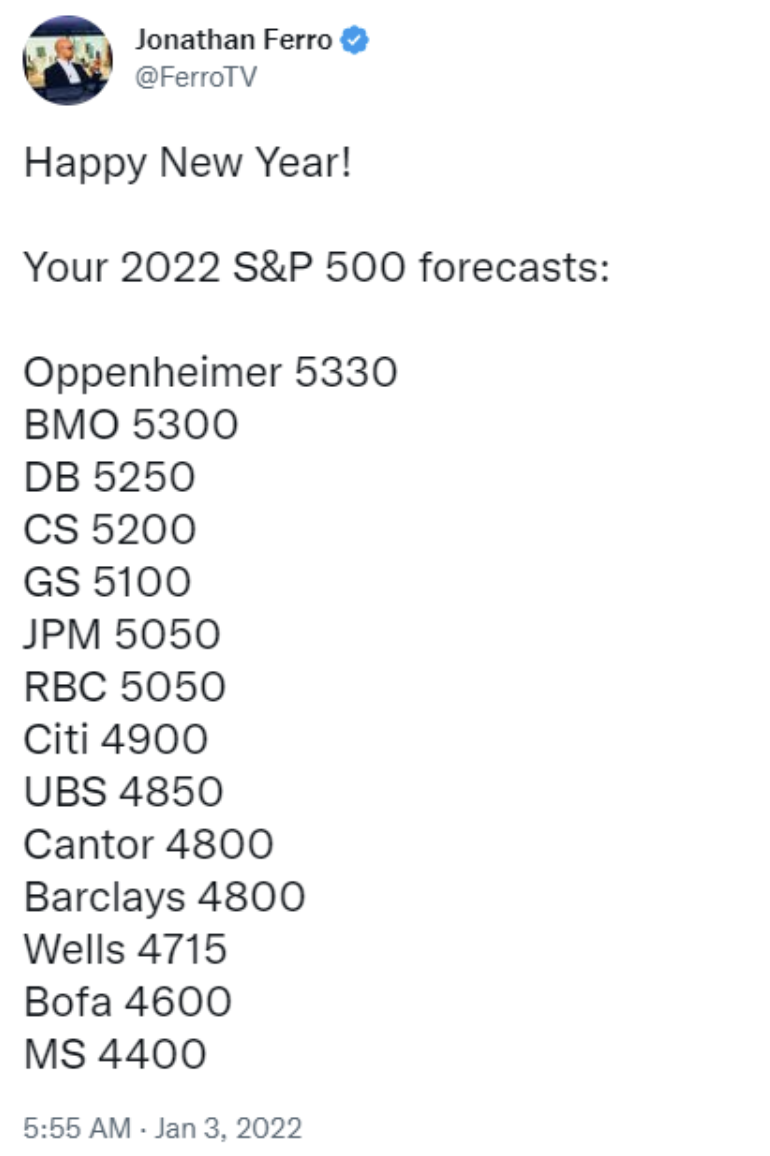

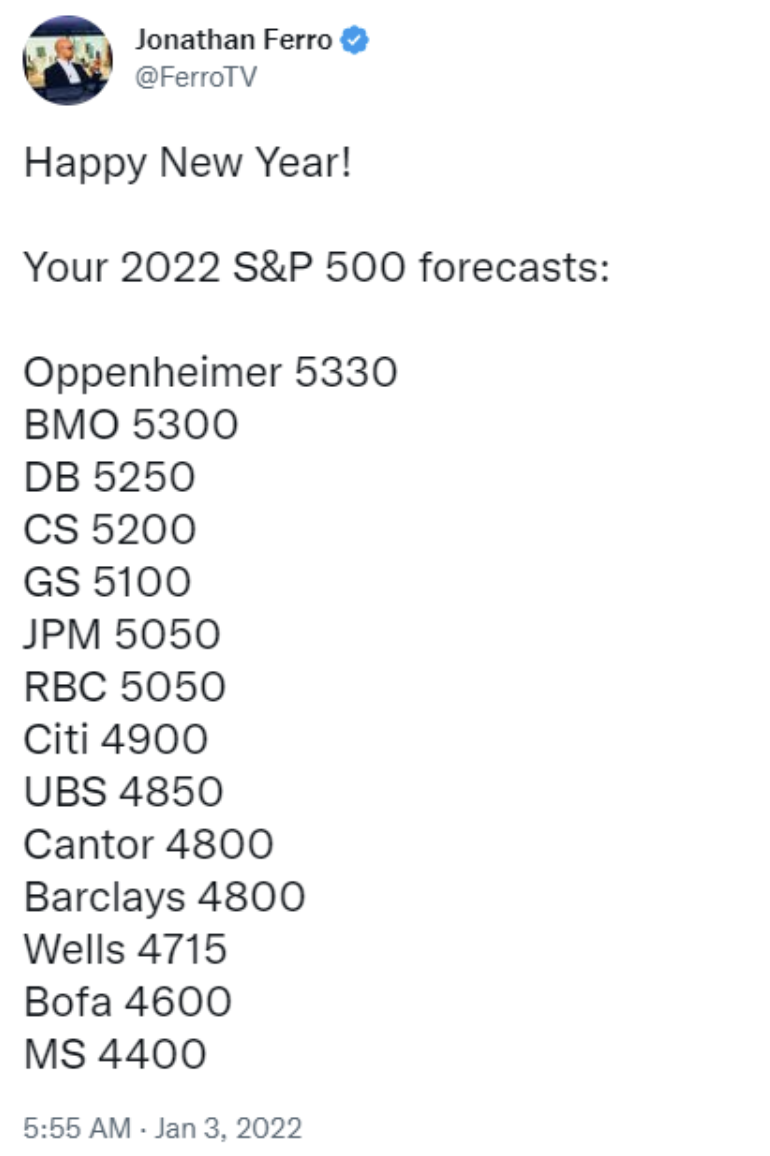

Don’t believe me? Bloomberg’s Jonathan Ferro posted the year-end 2022 stock market forecasts from all the big Wall Street firms at the start of the year.

The range of these 14 forecasts was 4,400 to almost 5,400. It ended the year at 3,839. The point of this isn’t to cast a shadow on Wall Street people. It’s part of their job and no doubt, they’re exceedingly skilled at what they do. The point is to show how silly it is to think you have the ability to predict what’s going to happen over any one-year period.

The range of these 14 forecasts was 4,400 to almost 5,400. It ended the year at 3,839. The point of this isn’t to cast a shadow on Wall Street people. It’s part of their job and no doubt, they’re exceedingly skilled at what they do. The point is to show how silly it is to think you have the ability to predict what’s going to happen over any one-year period.

So why do we pay so much attention to these forecasts and outlooks? Part of it is the human desire for control and understanding – we want to know what the future holds. But the truth is, the future is highly unpredictable. The most notable events and outcomes in a given year tend to come from “the tails” – events that are entirely unexpected and couldn’t have been predicted.

It’s important to remember that forecasts and outlooks are just educated guesses. They are not a guarantee of what will happen in the future. Instead of relying on predictions, it’s more important to focus on developing a well-diversified portfolio and sticking to a long-term investment strategy.

It’s also important to remember that markets are resilient and tend to recover from downturns. While the short-term can be highly volatile and unpredictable, over the long-term, markets tend to trend upward.

So while forecasts and outlooks may be unreliable, it’s important to remember that investing is a marathon, not a sprint. Instead of trying to predict the future, focus on building a well-diversified portfolio and sticking to a long-term investment strategy. And, it’s always best to seek professional advice to make sure you are on track to meet your financial goals.

Forecasts and outlooks are unreliable, but that doesn’t mean you should ignore them altogether. Instead, use them as a tool to gain a broad understanding of what might happen in the future, but don’t put too much weight on them. Set realistic expectations. Stay focused on your long-term goals, and make sure you have a well-diversified portfolio.

Source: CXO Advisory Group: https://www.cxoadvisory.com/gurus/

It’s that time of year again – investment management companies are releasing their forecasts and outlooks for the second half of the year. And while these predictions can be intriguing, it’s important to remember that they are often unreliable.

Recent studies have shown that most market forecasts are incorrect. In fact, a study by CXO Advisory Group found that the average stock market forecast accuracy was just 47%. This means that if you flipped a coin, you would have a better chance of being right.

Don’t believe me? Bloomberg’s Jonathan Ferro posted the year-end 2022 stock market forecasts from all the big Wall Street firms at the start of the year.

The range of these 14 forecasts was 4,400 to almost 5,400. It ended the year at 3,839. The point of this isn’t to cast a shadow on Wall Street people. It’s part of their job and no doubt, they’re exceedingly skilled at what they do. The point is to show how silly it is to think you have the ability to predict what’s going to happen over any one-year period.

The range of these 14 forecasts was 4,400 to almost 5,400. It ended the year at 3,839. The point of this isn’t to cast a shadow on Wall Street people. It’s part of their job and no doubt, they’re exceedingly skilled at what they do. The point is to show how silly it is to think you have the ability to predict what’s going to happen over any one-year period.

So why do we pay so much attention to these forecasts and outlooks? Part of it is the human desire for control and understanding – we want to know what the future holds. But the truth is, the future is highly unpredictable. The most notable events and outcomes in a given year tend to come from “the tails” – events that are entirely unexpected and couldn’t have been predicted.

It’s important to remember that forecasts and outlooks are just educated guesses. They are not a guarantee of what will happen in the future. Instead of relying on predictions, it’s more important to focus on developing a well-diversified portfolio and sticking to a long-term investment strategy.

It’s also important to remember that markets are resilient and tend to recover from downturns. While the short-term can be highly volatile and unpredictable, over the long-term, markets tend to trend upward.

So while forecasts and outlooks may be unreliable, it’s important to remember that investing is a marathon, not a sprint. Instead of trying to predict the future, focus on building a well-diversified portfolio and sticking to a long-term investment strategy. And, it’s always best to seek professional advice to make sure you are on track to meet your financial goals.

Forecasts and outlooks are unreliable, but that doesn’t mean you should ignore them altogether. Instead, use them as a tool to gain a broad understanding of what might happen in the future, but don’t put too much weight on them. Set realistic expectations. Stay focused on your long-term goals, and make sure you have a well-diversified portfolio.

Source: CXO Advisory Group: https://www.cxoadvisory.com/gurus/