The Power of Zeros

It has been 10 years since stock markets bottomed in 2008-09 following the financial turmoil caused by excessive leverage. Since then, many central banks globally have reduced interest rates to zero and collectively injected over US$10 trillion dollars into the economy. If you are wondering how many zeros there are in 10 trillion, the answer is 13. That’s $10,000,000,000,000! While the power of zeros has been effective in boosting both investor confidence and economies globally, we have made a few observations:

- Asset prices have risen dramatically over the last 10 years as the $10 trillion dollars from central banks found new homes, whether in real estate, bonds or stocks.

- Investors have received very little income as interest rates fell to zero.

- Companies were able to borrow at very low rates. Governments were borrowing at zero, high-quality companies were borrowing at the rates governments used to pay, and low-quality companies (bonds with a junk rating) were borrowing at lower rates than high-quality companies were typically borrowing at in the previous economic cycle. Needless to say, it was a borrowing spree.

- The world (governments, companies, individuals) has actually borrowed more money compared to 2008 when excessive leverage caused financial turmoil. The difference this time is that most of the debt is owed by governments and companies.

- Central banks have become too comfortable intervening and investors have relied on central banks to bail them out of trouble from time to time. It is a “perfect” combination of a party that has unlimited money printing power and a party that has a growing hunger for risk.

- Stocks have risen consistently as flows of new money were added, causing investors to be complacent.

- Investors are pushing their limits, always looking for the next big thing. In 2018, over 80% of the new companies listed in the United States had no earnings in the year leading up to their initial public offerings (IPOs) according to Jay Ritter, a well-known professor of finance at the University of Florida, who has written extensively on IPOs.

- Human productivity has not grown materially and neither have wages. Technology advancement has benefited owners (shareholders) more than employees.

- While unemployment in the United States is at a decades low, inflation has been benign and the U.S. government is running a deficit (expenses are exceeding tax revenue). In other words, tax revenue, when almost everyone is working, is not enough to pay their expenses.

- Economic growth has lagged behind asset price growth, causing the stock market capitalization-to-GDP ratio to reach a new high.

Sources: Wilshire Associates, U.S. Bureau of Economic Analysis

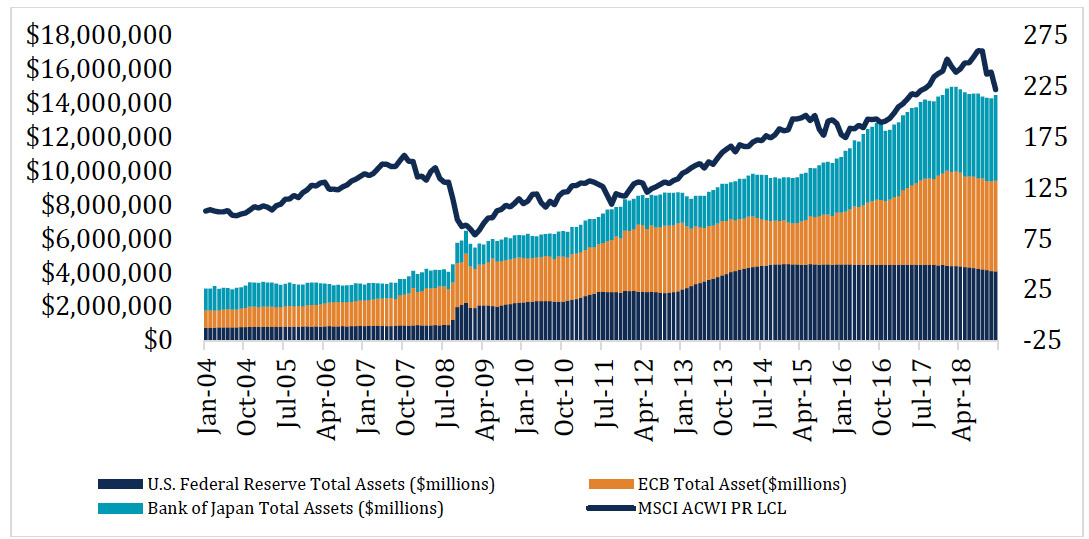

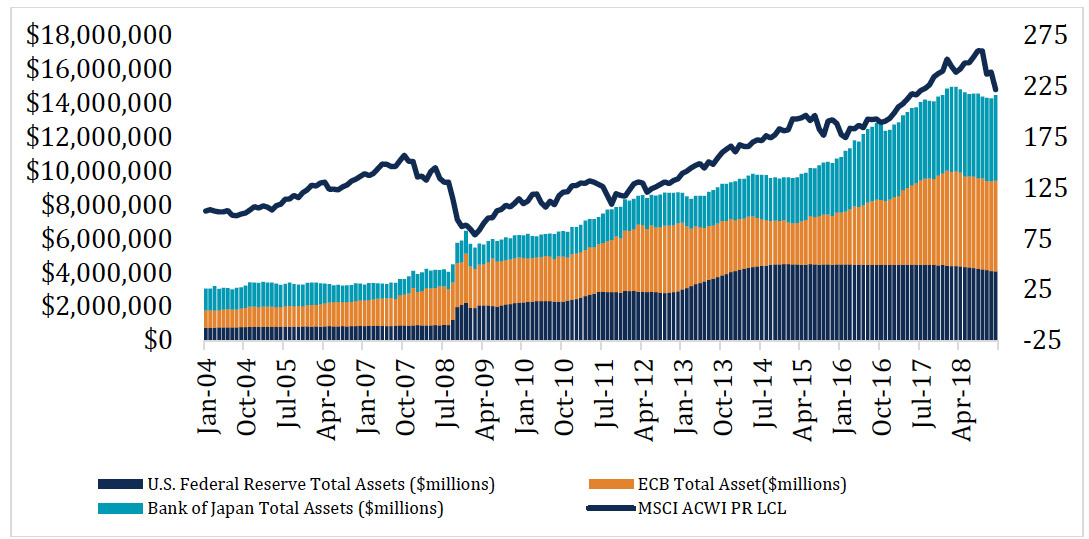

As the graph shows, there has been a direct relationship between central bank balance sheets and stock market performance (as measured by the MSCI All Country World Index (MSCI ACWI)) since 2008. Central bank balance sheets track money creation/supply globally. Larger money supply theoretically creates larger demand for stocks, leading prices higher. This relationship held very well during the last decade:

Left: Central banks’ assets in US$ (millions); Right: MSCI ACWI performance with a base of 100 from January 2004 // Source: Bloomberg

At a recent Berkshire Hathaway shareholders’ meeting, investing guru Warren Buffet said that no textbook could have explained the strange economy we live in today. We agree. However, the world moves forward and not making decisions is a luxury we do not have. One of the reasons investors trust Mr. Buffet is his discipline in following his investment principles. Mr. Buffet’s two rules for investing are: Rule number 1 – Never lose money. Rule number 2 – Never forget rule number 1. In a “difficult” time when human behaviours cannot be explained, these are important guiding principles. Generally, our “secret sauce” for not losing money is: 1) find and buy quality companies 2) pay the right price. We have not had problems finding quality companies as they are generally defined by 1) solid balance sheets 2) steady growth from selling unique and favourable products 3) strong management teams 4) discipline in re-investing capital. The challenge we face is buying these companies at the right price. What is a fair price when we are suddenly competing with $10 trillion of new capital?

We are convinced the metrics investors have used previously to value assets are ineffective, as they do not account for the new capital that is causing currencies to depreciate against assets. With extra money chasing a finite amount of assets, the price of assets is higher, but how much higher? Only history can confirm the new normal. In the meantime, we aim to own quality companies, avoid putting all of our eggs in one basket (diversify the portfolios), be flexible with prices but not excessive, and steer clear of trouble (if it sounds too good to be true, it probably is – investing in stocks can sometimes be a tricky game of transferring wealth from greedy investors to patient investors).

There is also a cost to being too defensive, as the risk of not owning assets is that the money you hold may have less purchasing power in the future. Quality assets generate cash flows, typically rise in value and are in demand. Money itself has no meaning as central banks can print more. Will central banks retrace a portion of that $10 trillion in the next decade or will they continue to print? That is the trillion-dollar question!

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer and Marchello Holditch, CFA, Vice-President and Portfolio Manager CI Multi-Asset Management

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer and Marchello Holditch, CFA, Vice-President and Portfolio Manager CI Multi-Asset Management

This document is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. This report may contain forward-looking statements about one or more funds, future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. United pools are managed by CI Investments Inc. Assante Wealth Management is a subsidiary of CI Investments Inc. Neither CI Investments Inc. nor its affiliates or their respective officers, directors, employees or advisors are responsible in any way for damages or losses of any kind whatsoever in respect of the use of this report. Commissions, trailing commissions, management fees and expenses may all be associated with investments in mutual funds and the use of the Asset Management Service. Any performance data shown assumes reinvestment of all distributions or dividends and does not take into account sales, redemption or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the fund prospectus and consult your advisor before investing. Assante Wealth Management and the Assante Wealth Management design are trademarks of CI Investments Inc. CI Multi-Asset Management is a division of CI Investments Inc. This report may not be reproduced, in whole or in part, in any manner whatsoever, without prior written permission of Assante Wealth Management. Copyright © 2019 Assante Wealth Management (Canada) Ltd. All rights reserved.

It has been 10 years since stock markets bottomed in 2008-09 following the financial turmoil caused by excessive leverage. Since then, many central banks globally have reduced interest rates to zero and collectively injected over US$10 trillion dollars into the economy. If you are wondering how many zeros there are in 10 trillion, the answer is 13. That’s $10,000,000,000,000! While the power of zeros has been effective in boosting both investor confidence and economies globally, we have made a few observations:

- Asset prices have risen dramatically over the last 10 years as the $10 trillion dollars from central banks found new homes, whether in real estate, bonds or stocks.

- Investors have received very little income as interest rates fell to zero.

- Companies were able to borrow at very low rates. Governments were borrowing at zero, high-quality companies were borrowing at the rates governments used to pay, and low-quality companies (bonds with a junk rating) were borrowing at lower rates than high-quality companies were typically borrowing at in the previous economic cycle. Needless to say, it was a borrowing spree.

- The world (governments, companies, individuals) has actually borrowed more money compared to 2008 when excessive leverage caused financial turmoil. The difference this time is that most of the debt is owed by governments and companies.

- Central banks have become too comfortable intervening and investors have relied on central banks to bail them out of trouble from time to time. It is a “perfect” combination of a party that has unlimited money printing power and a party that has a growing hunger for risk.

- Stocks have risen consistently as flows of new money were added, causing investors to be complacent.

- Investors are pushing their limits, always looking for the next big thing. In 2018, over 80% of the new companies listed in the United States had no earnings in the year leading up to their initial public offerings (IPOs) according to Jay Ritter, a well-known professor of finance at the University of Florida, who has written extensively on IPOs.

- Human productivity has not grown materially and neither have wages. Technology advancement has benefited owners (shareholders) more than employees.

- While unemployment in the United States is at a decades low, inflation has been benign and the U.S. government is running a deficit (expenses are exceeding tax revenue). In other words, tax revenue, when almost everyone is working, is not enough to pay their expenses.

- Economic growth has lagged behind asset price growth, causing the stock market capitalization-to-GDP ratio to reach a new high.

Sources: Wilshire Associates, U.S. Bureau of Economic Analysis

As the graph shows, there has been a direct relationship between central bank balance sheets and stock market performance (as measured by the MSCI All Country World Index (MSCI ACWI)) since 2008. Central bank balance sheets track money creation/supply globally. Larger money supply theoretically creates larger demand for stocks, leading prices higher. This relationship held very well during the last decade:

Left: Central banks’ assets in US$ (millions); Right: MSCI ACWI performance with a base of 100 from January 2004 // Source: Bloomberg

At a recent Berkshire Hathaway shareholders’ meeting, investing guru Warren Buffet said that no textbook could have explained the strange economy we live in today. We agree. However, the world moves forward and not making decisions is a luxury we do not have. One of the reasons investors trust Mr. Buffet is his discipline in following his investment principles. Mr. Buffet’s two rules for investing are: Rule number 1 – Never lose money. Rule number 2 – Never forget rule number 1. In a “difficult” time when human behaviours cannot be explained, these are important guiding principles. Generally, our “secret sauce” for not losing money is: 1) find and buy quality companies 2) pay the right price. We have not had problems finding quality companies as they are generally defined by 1) solid balance sheets 2) steady growth from selling unique and favourable products 3) strong management teams 4) discipline in re-investing capital. The challenge we face is buying these companies at the right price. What is a fair price when we are suddenly competing with $10 trillion of new capital?

We are convinced the metrics investors have used previously to value assets are ineffective, as they do not account for the new capital that is causing currencies to depreciate against assets. With extra money chasing a finite amount of assets, the price of assets is higher, but how much higher? Only history can confirm the new normal. In the meantime, we aim to own quality companies, avoid putting all of our eggs in one basket (diversify the portfolios), be flexible with prices but not excessive, and steer clear of trouble (if it sounds too good to be true, it probably is – investing in stocks can sometimes be a tricky game of transferring wealth from greedy investors to patient investors).

There is also a cost to being too defensive, as the risk of not owning assets is that the money you hold may have less purchasing power in the future. Quality assets generate cash flows, typically rise in value and are in demand. Money itself has no meaning as central banks can print more. Will central banks retrace a portion of that $10 trillion in the next decade or will they continue to print? That is the trillion-dollar question!

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer and Marchello Holditch, CFA, Vice-President and Portfolio Manager CI Multi-Asset Management

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer and Marchello Holditch, CFA, Vice-President and Portfolio Manager CI Multi-Asset Management

This document is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. This report may contain forward-looking statements about one or more funds, future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. United pools are managed by CI Investments Inc. Assante Wealth Management is a subsidiary of CI Investments Inc. Neither CI Investments Inc. nor its affiliates or their respective officers, directors, employees or advisors are responsible in any way for damages or losses of any kind whatsoever in respect of the use of this report. Commissions, trailing commissions, management fees and expenses may all be associated with investments in mutual funds and the use of the Asset Management Service. Any performance data shown assumes reinvestment of all distributions or dividends and does not take into account sales, redemption or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the fund prospectus and consult your advisor before investing. Assante Wealth Management and the Assante Wealth Management design are trademarks of CI Investments Inc. CI Multi-Asset Management is a division of CI Investments Inc. This report may not be reproduced, in whole or in part, in any manner whatsoever, without prior written permission of Assante Wealth Management. Copyright © 2019 Assante Wealth Management (Canada) Ltd. All rights reserved.