Running Hot

Will the inflation run last?

Consumers have only had to look at the gas pump or local grocery store the past few weeks to notice the increase in inflation and consumer prices. It seems like everything has gone up – consider:

- The U.S. consumer price index (excluding food and fuel) jumped by the most since the 1980s.

- The Canadian inflation numbers that followed suit were comparably high.

- Resources from cars and lumber to copper and oil have gone up in price.

- Producer prices – the input costs of components for goods producers – spiked.

- Wage inflation – a leading indicator of consumer price inflation – is accelerating.

The good news is our portfolios have benefited from exposure to inflation-sensitive areas like resources and other real assets, as well as underweight exposure to fixed income. Now the big question is – will this inflation be temporary as the U.S. Federal Reserve suggests?

What drives inflation?

Before we answer the pending question, let’s analyze the driving forces behind inflation:

- Scarce goods – The shutdown of manufacturing and fast rebound have caused shortages of almost everything. In some cases, production can be ramped up quickly, but in other areas, like semiconductors, expanding capacity will take time if new factories need to be built.

- Scarce workers – Employment reports show labour shortages are widespread. Some of this is due to unemployment benefits that are set to expire. Labour shortages should also recede as children return to school and health concerns subside as more people are vaccinated.

- Excess demand – It’s clear pent-up demand from lockdowns and excess savings (either from stimulus checks or reduced spending habits) are feeding demand. While unemployment benefits may stay elevated compared to the past, it’s unlikely broad stimulus checks will continue indefinitely. The focus of major spending programs is shifting to things like infrastructure, which are still supportive of inflation.

How long will this run last?

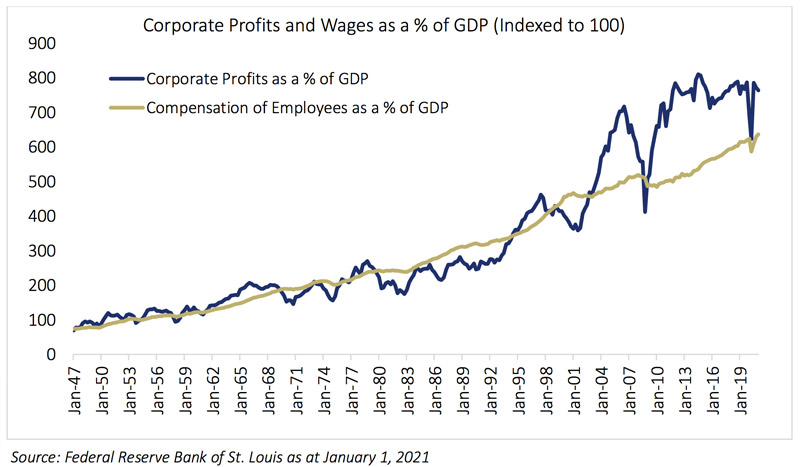

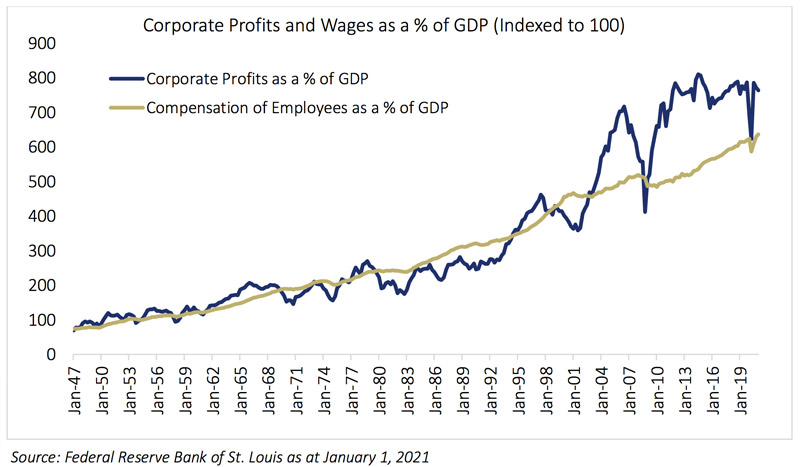

While the price pressures from scarce goods and pent-up demand are clearly transitory, wage gains could drive things further. However, it’s hard to imagine a sustained wage-price spiral where increasing wages lead to a vicious cycle of rising consumer prices and labour costs. One of the biggest reasons is the continued digitalization of the economy. While innovation creates new industries and jobs, there is increasing support for the view that the benefits are not evenly distributed.

Monetary policy has a large role to play as well. Clearly, the U.S. Federal Reserve is letting the economy run hot, emphasizing that 2% is no longer a ceiling but an average inflation target. We are closely monitoring the situation as aggressive policy stimulus combines with rapid economic growth like almost no other time in history. Overall, we expect inflation to peak this year, but remain elevated for years to come.

One point worth making is that even if the pace of price increases slow, prices are still going up in the long run. That means the best time to invest is yesterday, as the adage goes. Cash that generates no income is not offsetting inflation. We continue to use our portfolios’ flexibility to tactically allocate assets within our risk budgets and protect our investors’ purchasing power. As investors, asset price inflation is one type of inflation you should welcome.

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

Marchello Holditch, CFA, CAIA, Vice-President and Portfolio Manager, CI GAM | Multi-Asset Management

This document is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. This report may contain forward-looking statements about one or more funds, future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. CI Assante Wealth Management and its dealer subsidiaries, Assante Capital Management Ltd. and Assante Financial Management Ltd. (collectively “Assante”) are affiliates of CI GAM | Multi-Asset Management, which is a division of CI Global Asset Management. Evolution Private Managed Accounts are managed by CI Global Asset Management under the United Financial brand and are available exclusively through your Assante advisor. Neither CI Global Asset Management nor its affiliates or their respective officers, directors, employees or advisors are responsible in any way for damages or losses of any kind whatsoever in respect of the use of this report. Commissions, trailing commissions, management fees and expenses may all be associated with investments in mutual funds and the use of the Asset Management Service. Any performance data shown assumes reinvestment of all distributions or dividends and does not take into account sales, redemption or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the fund prospectus and consult your advisor before investing. CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. CI Global Asset Management is a registered business name of CI Investments Inc. This report may not be reproduced, in whole or in part, in any manner whatsoever, without prior written permission of CI Assante Wealth Management. Copyright © 2021 CI Assante Wealth Management. All rights reserved.

Will the inflation run last?

Consumers have only had to look at the gas pump or local grocery store the past few weeks to notice the increase in inflation and consumer prices. It seems like everything has gone up – consider:

- The U.S. consumer price index (excluding food and fuel) jumped by the most since the 1980s.

- The Canadian inflation numbers that followed suit were comparably high.

- Resources from cars and lumber to copper and oil have gone up in price.

- Producer prices – the input costs of components for goods producers – spiked.

- Wage inflation – a leading indicator of consumer price inflation – is accelerating.

The good news is our portfolios have benefited from exposure to inflation-sensitive areas like resources and other real assets, as well as underweight exposure to fixed income. Now the big question is – will this inflation be temporary as the U.S. Federal Reserve suggests?

What drives inflation?

Before we answer the pending question, let’s analyze the driving forces behind inflation:

- Scarce goods – The shutdown of manufacturing and fast rebound have caused shortages of almost everything. In some cases, production can be ramped up quickly, but in other areas, like semiconductors, expanding capacity will take time if new factories need to be built.

- Scarce workers – Employment reports show labour shortages are widespread. Some of this is due to unemployment benefits that are set to expire. Labour shortages should also recede as children return to school and health concerns subside as more people are vaccinated.

- Excess demand – It’s clear pent-up demand from lockdowns and excess savings (either from stimulus checks or reduced spending habits) are feeding demand. While unemployment benefits may stay elevated compared to the past, it’s unlikely broad stimulus checks will continue indefinitely. The focus of major spending programs is shifting to things like infrastructure, which are still supportive of inflation.

How long will this run last?

While the price pressures from scarce goods and pent-up demand are clearly transitory, wage gains could drive things further. However, it’s hard to imagine a sustained wage-price spiral where increasing wages lead to a vicious cycle of rising consumer prices and labour costs. One of the biggest reasons is the continued digitalization of the economy. While innovation creates new industries and jobs, there is increasing support for the view that the benefits are not evenly distributed.

Monetary policy has a large role to play as well. Clearly, the U.S. Federal Reserve is letting the economy run hot, emphasizing that 2% is no longer a ceiling but an average inflation target. We are closely monitoring the situation as aggressive policy stimulus combines with rapid economic growth like almost no other time in history. Overall, we expect inflation to peak this year, but remain elevated for years to come.

One point worth making is that even if the pace of price increases slow, prices are still going up in the long run. That means the best time to invest is yesterday, as the adage goes. Cash that generates no income is not offsetting inflation. We continue to use our portfolios’ flexibility to tactically allocate assets within our risk budgets and protect our investors’ purchasing power. As investors, asset price inflation is one type of inflation you should welcome.

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

By Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer

Marchello Holditch, CFA, CAIA, Vice-President and Portfolio Manager, CI GAM | Multi-Asset Management

This document is intended solely for information purposes. It is not a sales prospectus, nor should it be construed as an offer or an invitation to take part in an offer. This report may contain forward-looking statements about one or more funds, future performance, strategies or prospects, and possible future fund action. These statements reflect the portfolio managers’ current beliefs and are based on information currently available to them. Forward-looking statements are not guarantees of future performance. We caution you not to place undue reliance on these statements as a number of factors could cause actual events or results to differ materially from those expressed in any forward-looking statement, including economic, political and market changes and other developments. CI Assante Wealth Management and its dealer subsidiaries, Assante Capital Management Ltd. and Assante Financial Management Ltd. (collectively “Assante”) are affiliates of CI GAM | Multi-Asset Management, which is a division of CI Global Asset Management. Evolution Private Managed Accounts are managed by CI Global Asset Management under the United Financial brand and are available exclusively through your Assante advisor. Neither CI Global Asset Management nor its affiliates or their respective officers, directors, employees or advisors are responsible in any way for damages or losses of any kind whatsoever in respect of the use of this report. Commissions, trailing commissions, management fees and expenses may all be associated with investments in mutual funds and the use of the Asset Management Service. Any performance data shown assumes reinvestment of all distributions or dividends and does not take into account sales, redemption or optional charges or income taxes payable by any securityholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the fund prospectus and consult your advisor before investing. CI Assante Wealth Management is a registered business name of Assante Wealth Management (Canada) Ltd. CI Global Asset Management is a registered business name of CI Investments Inc. This report may not be reproduced, in whole or in part, in any manner whatsoever, without prior written permission of CI Assante Wealth Management. Copyright © 2021 CI Assante Wealth Management. All rights reserved.